How Do I Avoid Inheritance Tax In Kentucky . There is no estate tax in kentucky, making it one of many states to not do so. If the date of death is. It does have an inheritance tax, however. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. This article will explore the. Very simply, persons in class a are exempt from the inheritance tax.

from www.formsbank.com

In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: Very simply, persons in class a are exempt from the inheritance tax. It does have an inheritance tax, however. Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. There is no estate tax in kentucky, making it one of many states to not do so. This article will explore the. If the date of death is. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more.

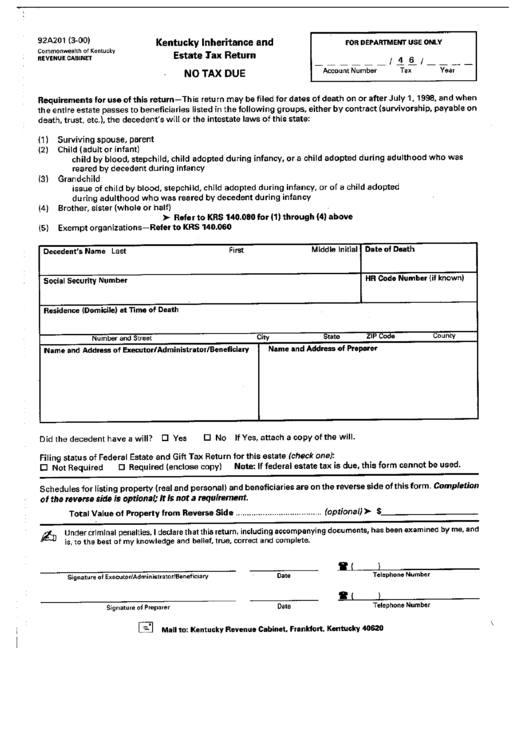

Fillable Form 92a201 Kentucky Inheritance And Estate Tax Return

How Do I Avoid Inheritance Tax In Kentucky In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: Very simply, persons in class a are exempt from the inheritance tax. Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. It does have an inheritance tax, however. There is no estate tax in kentucky, making it one of many states to not do so. In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. If the date of death is. This article will explore the. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a.

From www.dochub.com

Kentucky inheritance tax forms Fill out & sign online DocHub How Do I Avoid Inheritance Tax In Kentucky Very simply, persons in class a are exempt from the inheritance tax. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. This article. How Do I Avoid Inheritance Tax In Kentucky.

From www.easyfinance4u.com

How To Avoid Inheritance Taxes In The Uk Top 7 Legal Ways How Do I Avoid Inheritance Tax In Kentucky It does have an inheritance tax, however. This article will explore the. If the date of death is. Very simply, persons in class a are exempt from the inheritance tax. There is no estate tax in kentucky, making it one of many states to not do so. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes:. How Do I Avoid Inheritance Tax In Kentucky.

From aidhanfinancial.com

How To Avoid The Inheritance Tax in 3 steps Aidhan Financial How Do I Avoid Inheritance Tax In Kentucky Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: It does have an inheritance tax, however. There is no estate tax in kentucky, making it one of many states to not do so. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. Very simply,. How Do I Avoid Inheritance Tax In Kentucky.

From www.awesomefintech.com

Inheritance Tax AwesomeFinTech Blog How Do I Avoid Inheritance Tax In Kentucky In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. This article will explore the. It does have an inheritance tax, however. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: Very simply, persons in class a are exempt from the inheritance tax. There. How Do I Avoid Inheritance Tax In Kentucky.

From greyhouse.weissratings.com

How to Legally Avoid Estate & Inheritance Taxes Grey House & Weiss How Do I Avoid Inheritance Tax In Kentucky If the date of death is. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: It does have an inheritance tax, however. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. Very simply, persons in class a are exempt from. How Do I Avoid Inheritance Tax In Kentucky.

From inheritancetaxinuk.blogspot.com

Know how to Avoid Inheritance Tax on Property How Do I Avoid Inheritance Tax In Kentucky There is no estate tax in kentucky, making it one of many states to not do so. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate. How Do I Avoid Inheritance Tax In Kentucky.

From www.youtube.com

15 Ways to Avoid Inheritance Tax in 2024 YouTube How Do I Avoid Inheritance Tax In Kentucky Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: If the date of death is. It does have an inheritance tax, however. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. In this detailed guide of kentucky inheritance laws, we break down intestate succession,. How Do I Avoid Inheritance Tax In Kentucky.

From apkcatch.com

How to Avoid Inheritance Tax On Property? How Do I Avoid Inheritance Tax In Kentucky This article will explore the. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. If the date of death is. In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. In this. How Do I Avoid Inheritance Tax In Kentucky.

From www.zrivo.com

Kentucky Inheritance Tax 2024 How Do I Avoid Inheritance Tax In Kentucky In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. Very simply, persons in class a are exempt from the inheritance tax. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. It does have an inheritance. How Do I Avoid Inheritance Tax In Kentucky.

From ukcareguide.co.uk

15 BEST WAYS TO AVOID INHERITANCE TAX in 2022 On Property Wealth How Do I Avoid Inheritance Tax In Kentucky There is no estate tax in kentucky, making it one of many states to not do so. This article will explore the. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. Inheritance tax is. How Do I Avoid Inheritance Tax In Kentucky.

From islandstaxinformation.blogspot.com

Kentucky Inheritance Tax Calculator How Do I Avoid Inheritance Tax In Kentucky Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. If the date of death is. Inheritance and estate taxes are two separate taxes that are often referred to as 'death. How Do I Avoid Inheritance Tax In Kentucky.

From brackneylaw.com

Kentucky's Inheritance Tax Brackney Law How Do I Avoid Inheritance Tax In Kentucky Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. There is no estate tax in kentucky, making it. How Do I Avoid Inheritance Tax In Kentucky.

From www.woodwardfinancials.co.uk

How to avoid inheritance tax — Woodward Financials How Do I Avoid Inheritance Tax In Kentucky In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. There is no estate tax in kentucky, making it one of many states to not do so. If the date of death is. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: This article will. How Do I Avoid Inheritance Tax In Kentucky.

From www.genuinepropertybuyers.co.uk

Infographic 6 ways to legally avoid inheritance tax How Do I Avoid Inheritance Tax In Kentucky If the date of death is. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. Very simply, persons in class a are exempt from the inheritance tax. There is no estate tax in kentucky, making it one of many states to not do so.. How Do I Avoid Inheritance Tax In Kentucky.

From www.formsbank.com

Fillable Form 92a201 Kentucky Inheritance And Estate Tax Return How Do I Avoid Inheritance Tax In Kentucky There is no estate tax in kentucky, making it one of many states to not do so. Very simply, persons in class a are exempt from the inheritance tax. If the date of death is. It does have an inheritance tax, however. In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate. How Do I Avoid Inheritance Tax In Kentucky.

From www.zrivo.com

Kentucky Inheritance Tax 2024 How Do I Avoid Inheritance Tax In Kentucky In this detailed guide of kentucky inheritance laws, we break down intestate succession, probate, taxes, what makes a will valid and more. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a.. How Do I Avoid Inheritance Tax In Kentucky.

From inheritancepontema.blogspot.com

Inheritance How To Avoid Inheritance Tax How Do I Avoid Inheritance Tax In Kentucky Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. This article will explore the. Inheritance tax laws in kentucky divide beneficiaries of a will into three classes: It does have an inheritance tax, however. If the date of death is. Very simply, persons in class a are exempt from the inheritance tax.. How Do I Avoid Inheritance Tax In Kentucky.

From nationalpensionhelpline.ie

How to avoid inheritance tax legally National Pension Helpline How Do I Avoid Inheritance Tax In Kentucky In this comprehensive guide, we'll demystify the complexities of inheritance taxation in the bluegrass state, helping you navigate the rules and. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a. Very simply, persons in class a are exempt from the inheritance tax. There is. How Do I Avoid Inheritance Tax In Kentucky.